Sign in

Transform Your Business with Machinery Loan!

Flexible loan options to help you acquire the right machinery for business expansion.

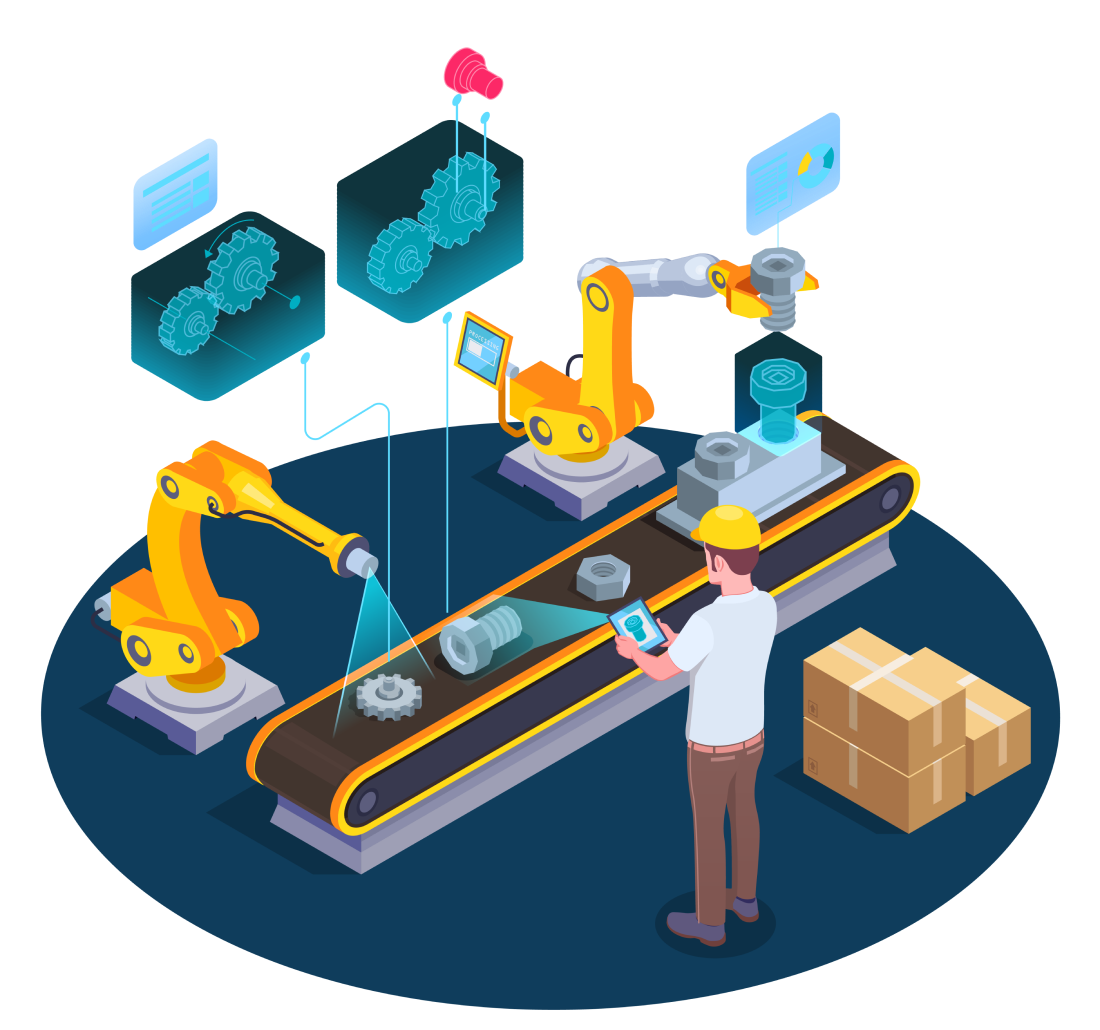

A machinery loan is a financial solution designed to empower businesses to acquire or upgrade essential equipment without straining their working capital. Machinery loans for MSMEs, startups, SMEs, larger businesses, and enterprises. Machinery financing ensures businesses can enhance operational efficiency, integrate advanced technology, and stay competitive in the market.

What are Machinery Loans?

Machinery loans are a type of business loan that can be used to buy new machines or upgrade existing equipment. Machinery loans help businesses overcome financial barriers, enabling them to scale operations without interruptions. With Ruloans, you can access machinery lending options from India’s top-tier banks, NBFCs, and financial institutions. Whether you need a loan for machinery purchase or machinery finance for upgrades, we ensure your business gets the best deal with higher loan amounts, attractive interest rates, and flexible loan tenures.

Features and Benefits of Machinery Loan

Wide range of machinery and equipment loan options

Loan Amount Range from ₹5 Lakh to ₹5 Crore

Digital & Minimal Documentation

Tenure from 12 to 60 Months

Catering to customers in rural & semi-urban areas

Avail machinery loans for new business MSMEs, or SMEs

Loans can be availed for up to 100% of the equipment price

Rate of Interest (ROI) Starting from 12% Onwards

No Additional Collateral is Required

Easy & Quick Disbursal

Customized Repayment & Flexible foreclosure options

Benefits for Government Loans for Machinery Purchases

Upgrade your business operations effortlessly with our hassle-free machinery & equipment financing options.

Eligibility Criteria for Machinery Loan

Applicant must be between 21 and 65 years of age

A credit score of 650 or higher

Minimum business vintage of 3 years

Documentation Required for Machinery Loan

KYC Documents

(Identity & Residence)

Aadhar card, PAN card, driving license, passport, etc

Income tax returns (ITR) for the last 3 years.

Business ownership proof.

Proforma invoice of the machinery purchase.

Bank statements for the last 6 months.

Machinery Loan EMI Calculator

A Machinery Loan EMI Calculator is an online tool that helps borrowers calculate the Equated Monthly Installment (EMI) for a machinery loan. By inputting details such as the loan amount, interest rate, and loan tenure, the calculator provides an accurate estimate of the monthly payments, enabling businesses to plan their finances and manage cash flow effectively when investing in machinery.

Wide Range of Machinery & Equipment Financing Options that suit your Business Requirements

Medical Equipment Loans

Machinery Equipment Loan

Construction machinery finance

Manufacturing equipment loans

Farm machinery loans/finance

Aviation industry equipment loans

Used machinery loan

Loan Against Machinery

How to Apply Online for a Machinery Loan

Follow these simple steps to apply for a machinery and equipment loan online through Ruloans.

Visit the website and navigate to the Machinery Loan section

- Go to ruloans.com.

- Click on Loans and select Machinery Loan.

Apply & Verify with OTP

- Click Apply Now.

- Sign in with your mobile number, and login via OTP verification.

Fill out the Consent Form & Submit

- Complete the Consent Form, agree to the Terms & Conditions, verify with OTP

- Enter address & income details along with provide loan details.

- Select the provider Ruloans Experts, then click on continue with applied amount, and submit your application.

Wait for approval while Ruloans gets you the best deal that suits your business needs.

With Ruloans, you can also explore options for loan against machinery to unlock the value of your existing assets and ensure uninterrupted cash flow for your business. As India’s leading loan distribution company, we offer a wide range of MSME loans for machinery needs, providing a seamless process to secure financing for your equipment.

Machinery Loan FAQs

The interest rate for machinery finance varies depending on the lender, loan amount, and tenure. With Ruloans, you can access heavy machinery financing and other equipment loans at attractive interest rates, ensuring affordability and suitability for your business needs.

Yes, machinery can often be used as collateral for a loan against machinery, depending on the lender's policies. However, some lenders also provide machinery loan without security, which does not require additional collateral.

The interest rate for an MSME machinery loan varies by lender and depends on factors like loan amount, tenure, and the borrower’s credit profile. Comparing offers from multiple lenders can help you secure a favorable rate.

Several Banks and NBFCs in India provide machinery loans to assist businesses in acquiring or upgrading equipment. Prominent lenders include Kotak Mahindra Bank Limited, Poonawalla Fincorp Limited, Cholamandalam, U Gro Capital Ltd, Yes Bank Limited, Profectus Capital, MAS Financial Services Limited, Protium Finance Limited, and Clix Capital Services Pvt Ltd. These lenders offer tailored machinery loan products with attractive interest rates and flexible repayment options to meet various business requirements.

Machinery refinancing enables businesses to unlock the value of their existing machinery by availing funds against it. Renowned lenders providing machinery refinancing solutions in India include Poonawalla Fincorp Limited, Kotak Mahindra Bank Limited, Cholamandalam, U Gro Capital Ltd, Yes Bank Limited, and Protium Finance Limited. These loan against machinery type aim to boost working capital and streamline cash flow management for businesses.

The eligibility criteria for a machinery and equipment loan generally include:

A machinery loan can be either secured or unsecured. Secured loans require collateral such as the machinery itself, while unsecured loans do not require additional security but may have higher interest rates