Sign in

We Facilitate

Wide Range of Financial Products That suits your customer's needs!

Home Loan

Your Dream Home Awaits - Explore Our Range Of Home Loan Products.

Check Eligibility![]()

Loan against Property

Unlock your property's value with tailored loan solutions..

Check Eligibility![]()

Personal Loan

Achieve your dreams with our versatile personal loan options.

Check Eligibility![]()

Business Loan

Boost your business growth with our flexible financing options.

Check Eligibility![]()

Education Loan

Invest in your child's future with our specialized education loans.

Check Eligibility![]()

Car Loan

Drive your dream car with our quick and flexible car loans.

Check Eligibility![]()

Gold Loan

Meet your financial needs with gold loans from trusted banks.

Check Eligibility![]()

Credit Cards

Upgrade your lifestyle with feature-packed, rewarding credit cards.

Check Eligibility![]()

Insurance

Wide Range of Insurance Products

Life Insurance

Protect Your Loved One's Future With Our Reliable Life Insurance Plans.

Starting from ₹ 450/month*![]()

Health Insurance

Ensuring Your Health Is In Good Hands - Explore Our Top-notch Insurance Solutions.

Starting from ₹ 450/month*![]()

General Insurance

Insurance Made Easy - Your Protection, Our Expertise.

Starting from ₹ 450/month*![]()

Bills And Payments

Effortless Bill Payments and Recharges, Designed to Meet Your Needs.

Bill Payments

Simplify All Your Bill Payments with Bharat Bill Pay System (BBPS)!

Check Eligibility![]()

Ruloans – India’s Leading Loan Distribution Company

25

+Years of Experience

275

+Financial Institution Partners

Presence in

4,000

+Cities Through A Wide Branch Network

₹

1.4

lakh cr+In Loans Disbursed

Advantages of Ruloans

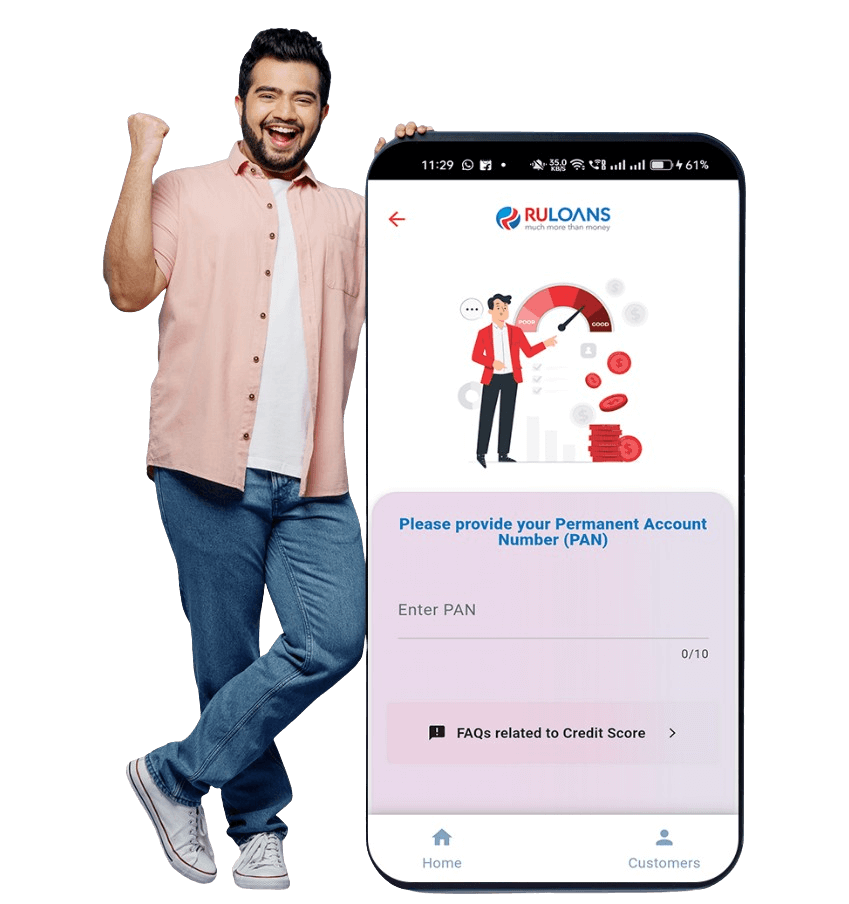

Ruconnect App - India’s First B2B Loan Distribution Channel Partner App

Discover Ruconnect, India’s first B2B fintech app in the loan distribution domain, brought to you by Ruloans Distribution Services Pvt. Ltd, a trusted digital loan service provider for lenders across India. Designed exclusively for channel partners, Ruconnect offers a comprehensive suite of financial products including personal loans, business loans, home loans, loans against property, credit cards, insurance, and more.

With Ruconnect, you can:

- Access a PAN India network of lenders and customers.

- Benefit from being the first in the industry to offer a Free CIBIL Check.

- Use convenient features like an EMI calculator to assist customers.

- Empower your customers with seamless loan options.

- Start your journey as a successful loan distribution partner and begin earning

What People Say About Us?

FAQs

Anyone from loan agents, ex-bankers, financial analysts, Insurance agents, mutual fund agents, chartered accountants, builders, or professionals from any other field can become a partner with Ruloans. If you’re interested in offering a wide range of financial products and earning attractive commissions, you’re welcome to join us.

To become a DSA Partner (Direct Selling Agent) with Ruloans, follow these simple steps:

,Step 1: Visit the Ruloans website and click on the ‘Become a Partner’ option.

Step 2: Complete the registration form by filling in your details and submitting it.

Step 3: A member of the Ruloans support team will contact you to guide you through the next steps and arrange a meeting.

Step 4: During the meeting, a Ruloans Manager will explain the lead generation process and provide you with all the necessary information.

Step 5: Once you understand and are comfortable with the processes, an agreement will be signed between you and Ruloans.

After the agreement is signed and stamped, you will officially become a Ruloans DSA Agent.

Connect with us today to start your journey as a DSA Agent and unlock the potential to earn attractive commissions while helping customers secure the best financial products!

To become a Ruloans DSA, you need to meet the following Eligibility Criteria:

- Age Requirement: You must be at least 25 years old.

- Nationality: You must be a Resident Citizen of India.

- Educational Qualifications: No specific educational qualification is required.

- Professional Qualifications: Whether you are a working professional or a business owner, you can register as a Ruloans loan agent. Ideal candidates include loan agents, ex-bankers, financial analysts, mutual fund agents, chartered accountants, and builders.

Ruloans welcomes individuals from diverse professional backgrounds who are looking to expand their income opportunities.

At Ruloans, our DSA registration process is designed to be straightforward and hassle-free. The required documents for KYC verification include:

- Aadhaar Card

- PAN Card

- Two passport-size photographs

- GST Registration (for companies, if applicable)

- Proof of Employment: Salary slips if employed; account statements and address proof if running a business; or invoices and financial statements if self-employed.

- Bank Account Details: Your bank statement for the last 3 months.

These documents help us ensure a seamless registration process, getting you started on your journey as a Ruloans DSA in no time.

Ruloans is committed to the success of its DSAs by offering extensive support in the following areas:

- Comprehensive Training: We provide detailed training sessions to help you understand our products, processes, and the market.

- Marketing Support: You can get leads, marketing materials, and strategies from Ruloans to promote your services effectively.

- Timely Payouts: We ensure that you receive your commissions on time, providing a smooth and transparent payout process.

- By partnering with Ruloans, you get all the support you need to grow and succeed as a DSA.

Get Loans for your customers from India’s Top-Tier Lenders