Business loans are given with 2 types of interest rates i.e. fixed and fluctuating. Usually for every other type of loan, the EMI cycle is monthly. Here in business loans, the EMI cycles are weekly, fortnightly, Monthly, Bi-Monthly, Quarterly, Semi-Annually and Annually. The loans are disbursed immediately after the documentation is complete. The overall process is hassle free.

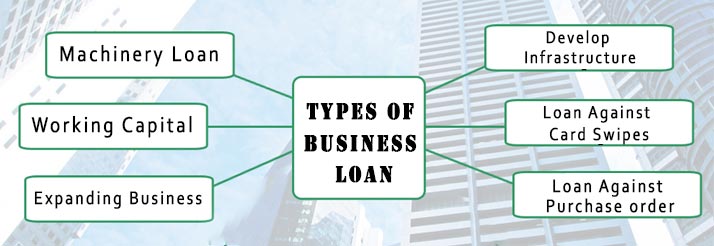

Ruloans offer different types of Business loans. We have mentioned some of them here;

Loan for expanding business:

To encourage businessmen in growing their enterprise, Banks/NBFC give quick business loans for expanding from local to national, creating a brand, increasing profits etc. The interest rate here is decided on the basis of the tenure, the loan amount and also the financials and credit history of the businessman. These factors give the bank an understanding if the borrower can repay the amount.

Loan to develop Infrastructure:

To make your establishment appealing to the eyes of the consumer, you can apply for a loan to develop infrastructure for your space. With this loan, you can hire new labor, revamp your interiors for the space and give it a new look. This loan helps to get your space a new look without hurting the capital needed to run your business.

Loan against card swipes:

Merchants and sellers who keep card machines can avail for a loan against card swipes made for a certain month. The loan amount can be anything between 1 lakh to 1 crore. This depends on your monthly statements and credit history. If your credit score and sales is very good, some banks can even give you loans up to 200% of the monthly sales. The tenure for this loan is very short and ranges between 6 to 12 months*. Usually Banks and NBFC’s apply less processing fees to encourage the use of plastic money. These charges are around 2%*.

Also the basic eligibility here is that the borrower must have an ongoing business since 1 year with a turnover of minimum 20 lakhs. The monthly card usage must cross 5 lakhs every month. With this criteria, he can apply for a loan.

Loan against purchase orders:

This loan is taken by businessmen when they have little working capital to fulfil orders. In order to not lose good customers and business, a businessman can avail of a loan against a purchase order. By getting this loan he can complete his order and continue to grow his/her business.

Usually the tenure of such a loan is flexible to the tune of 30 to 60 days as per the company/business profile, type of business and loan amount. Here too, the bank/NBFC will provide a loan to the tune of 80% of the purchase order. The loan amount can be between 5 lakh to 1 crore*. Here the loan can be paid in installments and also in one single installment.

Loan for working capital and SME:

This type of loan is taken by an existing business. They take this loan when they have little or no working capital to run and sustain their business. The working capital is used for the day to day running of the business, paying the salaries of the labor/employees etc. Hence for the smooth functioning of the business, taking this loan.

An SME is a small and medium enterprise. They need a lot of working capital all the time up to the point of their business running. For them this type of a loan fits well as they can operate and sell without any hassle. Here, the loans have very little pre-payment and partly payment charges.

Click here to apply for a quick business loan.