India’s start-up ecosystem is budding as more and more businesses are being set up. However, launching and operating a start-up is challenging for founders who dedicate their efforts, savings, time, and energy to growing their business from the ground up. In the initial years, a considerable source of funding is required so that the start-up can grow and become profitable.

How do founders source this funding?

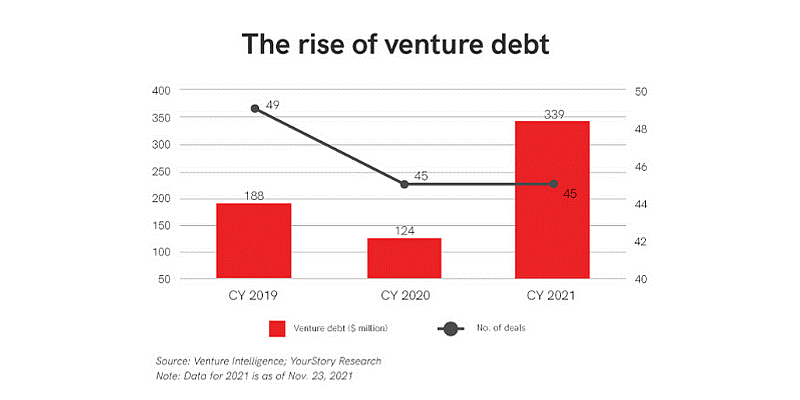

In most cases, founders used to give up equity to raise funds for their businesses. However, this meant diluting their ownership and sharing business profits. In recent times, however, start-ups have been making a transition from equity to debt. Have a look –

(Source: https://yourstory.com/2021/12/funding-boom-venture-debt-sweet-spot-early-stage-startups-/amp)

The reasons for the transition are the drawbacks of issuing equity and the merits of getting loans. Have a look –

Cons of equity funding –

- You lose part ownership in your business

- You have to give investors a share of business profits

- The investors get a say in the management of the business. This dilutes your control

- Equity funding can be a difficult affair as you need to find the right venture capitalist or angel investor for the funding

Pros of debt funding –

- Debt funding helps founders retain ownership of their businesses. In fact, equity dilution is the only concern that push start-ups

- It is cost effective

- The business takes better care of its finances to ensure that the debt is repaid on time

Moreover, debt funding is quite easily available, thanks to banks and non-banking financial companies (NBFCs) offering such loans.

Business loans help start-ups get the funds that they need without diluting their company’s equity. The benefits of these loans are as follows –

- Hassle-free application and availability

Business loans are now available online as most banks and NBFCs have digitized their process. So, when you need a business loan, apply online and get the funds within the shortest period of time.

- High-value capital sourcing

High loan amounts are available under business loans. These amounts help you fund your business optimally and get the desired funds based on your needs.

- Unsecured loans

Many business loans are unsecured in nature. This means that you don’t have to pledge any collateral security to avail of the funds. The funds are sanctioned basis your business’s financial standing, revenue, and profitability.

This aspect makes the loan relevant for start-ups with limited or no assets against which they can get the loan they need.

- Affordable interest rates

The interest rates on business loans are affordable. This makes it easier for start-ups to service the debt and pay it off without hurting their cash flow or profits. In fact, compared to equity dilution and profit sharing, paying the interest on business loans is more cost-effective for start-ups.

- Flexible repayment options

Business loans allow flexible repayment options to help start-ups repay their debt in a manner that suits their finances. Your business can avail of term loans and pay back the debt in the form of EMIs over the repayment tenure. Alternatively, you can avail of a line of credit, withdraw only what you need, and pay interest only on the borrowed amount.

- Multiple usages

Business loans are multipurpose in nature. You can get a loan to recruit the right talent, market expansion, promote your business, etc. Moreover, different types of business loans are available in the market, like working capital loans, equipment loans, micro-loans, etc. You can choose a loan depending on your need and get the desired funds.

- Simple eligibility and documentation

Business loans have a simple eligibility requirement and are sanctioned based on a minimal business loan document list. As such, getting the loan is no fuss or hassle, making it the go-to solution for your business funding needs.

The bottom line

Many start-ups are going the debt way to fund the operation and growth of their business. You can too. Raising funds for a start-up through debt is easier, less costly, and quicker. You can get the funds for multiple needs without having to part with equity. If you choose unsecured start-up loans, you can even get the funds without pledging any asset.

Ruloans offers a range of quick business loan solutions. You can compare and get the most cost-effective loan and raise funds for your business needs. So, if your business needs funds, don’t look elsewhere. Opt for business loans and fulfill your financial requirements.