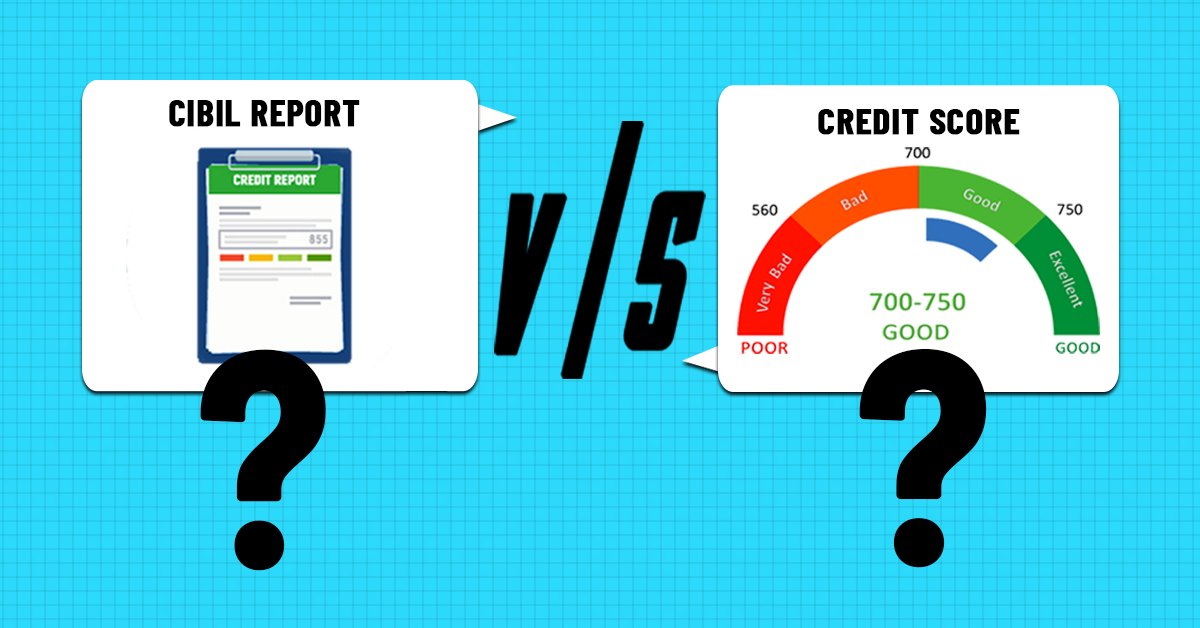

People seeking loans are often faced with terminology that confuses the seeker. Some of these terms include terms like Credit Score, Credit Report, CIBIL Report, and CIBIL Score. To take that perplexed expression off their faces, let’s look at these terms a little in detail in order to understand the difference between each term.

Banks, Credit Institutions, or Money Lenders today are faced with many issues in the process of approving loans. Most of these issues are to do with whether you can pay back the loan. To determine this, bankers and lenders look at such scores and reports in question. These scores and reports have to do with your credit history to assure the minimization of risk or default for the lenders.

What are Credit Reports?

Credit Reports are basically reports that report your credit history with a detailed breakdown of your credit activity. These reports are statutorily prepared by independent credit bureaus. In the process of creating your report, the bureau collects information about your financial status that determines your creditworthiness. Based on these reports, the lender makes a decision whether you are worthy of credit or not.

Credit reports detail the summary of your credit history. These reports contain your personal information, the particulars of your lines of credit, and public records of bankruptcies. These reports list the entities who have asked to see your creditworthiness. Personal information such as your current address, previous addresses, and employment history are provided in these reports. Your reports collected by bureaus also include a summary of credit history inclusive of details of bank and credit card accounts with summaries of balances, limits, and dates.

What are Credit Scores?

Credit scores are a three-digit number from 300 to 900 that represents your creditworthiness. Credit scores when on the higher side represent a positive outlook towards loan approval, whereas when the scores are lower, the chances of your loan being approved are less. Your credit scores are arrived at after looking at your credit history. Your credit history will include the number of your open accounts, total debts, repayment of debt history, and other such details as may be statutory to your loan approval. In short, the scoring system determines the bank’s, financial institution’s, or money lender’s decision to offer you credit.

Internationally, there are three major credit reporting bureaus, namely Equifax, Experian, and TransUnion. These companies specialize in the collection of financial information about your personal finances, and bill-paying habits to create a unique credit report. The information collected by these companies are similar, but for small differences.

TransUnion, or TransUnion CIBIL Limited was previously known by the name of Credit Information Bureau India Limited, or just CIBIL. This credit bureau, or credit rating agency came to be known as ‘TransUnion’ after TransUnion acquired a 92.1 percent stake in CIBIL. This bureau has comprehensive updated data with regards records of all credit-related activities of companies, and individuals. This data includes usage statistics related to credit cards and loans.

The CIBIL website states quite clearly that, “The bureau provides information and tools for gaining a clear understanding of credit history and financial reputation, and guarding against the theft of personal information and potential fraud. For businesses, the bureau provides powerful information solutions, backed by professional service and current, comprehensive data, for making better, and more informed decisions.”

CIBIL Report

In a CIBIL Report, the TransUnion CIBIL Limited details a consolidated ‘Credit Report’ to contain a client’s CIBIL Score with your credit summary. This summary includes your personal information, contact particulars, employment history, and history of borrowings. Most banks, financial institutions, and lenders examine your ‘CIBIL Report’ and ‘CIBIL Score’ to assess your creditworthiness.

CIBIL Score

TransUnion CIBIL Limited calculates an ‘individual credit score’, called ‘CIBIL Score’ based on data related to the individual. This three-digit numeric summarises a consumer’s credit history based on past credit behaviour, borrowings, and repayments to share with lenders featured in the CIBIL Report.

This three-digit numeric ranging anywhere from 300 to 900 can be found in the Accounts and Enquiries section of your CIBIL Report indicating your creditworthiness. CIBIL calculates your credit score known as CIBIL Score based on your previous and present credit-related actions, to determine future credit behaviour. The higher your CIBIL Score, the better your chances of your loan being approved. Established in the year 2000, TransUnion CIBIL has one of the largest collections of financial information.

Now that you have a fair knowledge of credit scores and reports, click here for your Credit Score, and arm yourself to acquire that loan you have in mind from Ruloans for much more than money