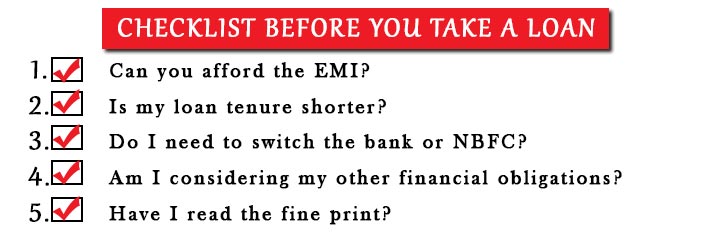

Taking a loan is a huge financial decision for anyone. Though the process of borrowing loan has become easier, the worry is still the same. A person has to think over various aspects before and while taking a loan. We have come up with a checklist for you of things you should check before taking any loan.

- Can you afford the EMI?

This you have to check before and while applying for any loan. You have to crunch out a specific amount of money every month to pay your EMIs regularly. So before applying for loan, you should check your other financial obligations and make sure that whether you can pay an EMI or not. Also while applying you should choose an EMI amount as per your capacity of repayment. EMI is determined on the basis of interest rate, principal amount of loan and the tenure. Many banks and NBFCs offer customized EMI plans. You should opt for one as per your requirements.

- Is my loan tenure shorter?

Many people believe that longer tenures are good because longer tenure means lower EMIs. But what they don’t understand is longer tenure means more interest rate which will ultimately lead you to pay more. So always make sure you ask for a shorter tenure. But this doesn’t mean that you opt for a very short tenure which will put you in a place of financial jeopardy. Choose shorter tenure but choose wisely.

- Do I need to switch the bank or NBFC?

Many times you take loan from one financial institution because they offer lower interest rates with other benefits. But with uncertainty of financial market, they might raise their charges in future and you would like to opt for another financial institution with better interest rates and other benefits. Here you can switch the money lenders but make sure that such provisions are there in the loan agreement.

- Am I considering my other financial obligations?

When you take a loan, its repayment is not the only financial obligation you have. You have to provide for your family, pay other utility bills and other loans if you have any. So when you opt for a loan, you should consider these things. You should be able to balance both, your existing and suspected future obligations and loan repayment.

- Have I read the fine print?

When you sign the loan agreement, there are papers with that agreement which have all the terms and conditions attached to it. Make sure you read each and every word of that fine print. If you have any questions, get the right answers immediately before signing the loan agreement. This way if there are any financial complications in future, you’ll be ready to face them.

Now that you have a checklist ready, why don’t you apply for a loan? Check your eligibility here!