Credit Cards and Loans

Credit Cards

Elevate Your Lifestyle With Our Feature-packed And Rewarding Credit Cards.

Check Eligibility![]()

Personal Loan

Turn Your Aspirations Into Reality With Our Comprehensive Selection Of Personal Loans.

Check Eligibility![]()

Home Loan

Your Dream Home Awaits - Explore Our Range Of Home Loan Products.

Check Eligibility![]()

Business Loan

Get The Financial Boost You Need For Your Business With Our Flexible Business Loans.

Check Eligibility![]()

Loan against Property

Utilize Your Property's Potential To Fulfill Your Aspirations With Our Tailored Loan Against Property Options.

Check Eligibility![]()

Gold Loan

Fulfill Your Financial Needs With Gold Loan From Various Banking Partners

Check Eligibility![]()

Education Loan

Secure Your Child's Future With Our Specialized Education Loans For Their Academic Journey.

Check Eligibility![]()

Car Loan

Turn Your Dream Car Into A Reality With Our Lightning-fast And Flexible Car Loans

Check Eligibility![]()

Insurance

Life Insurance

Protect Your Loved One's Future With Our Reliable Life Insurance Plans.

Starting from ₹ 450/month*![]()

Health Insurance

Ensuring Your Health Is In Good Hands - Explore Our Top-notch Insurance Solutions.

Starting from ₹ 450/month*![]()

General Insurance

Insurance Made Easy - Your Protection, Our Expertise.

Starting from ₹ 450/month*![]()

EMI Calculator

You can check your EMI based on the loan amount, tenure, and the interest rate the lender is offering.

Monthly loan EMI

₹8,056

Principal Amount₹1,000,000

Interest Payable₹933,440

Total Amount payable: ₹1,933,440.00

About Ruloans

We help our clients to achieve their desired goals.

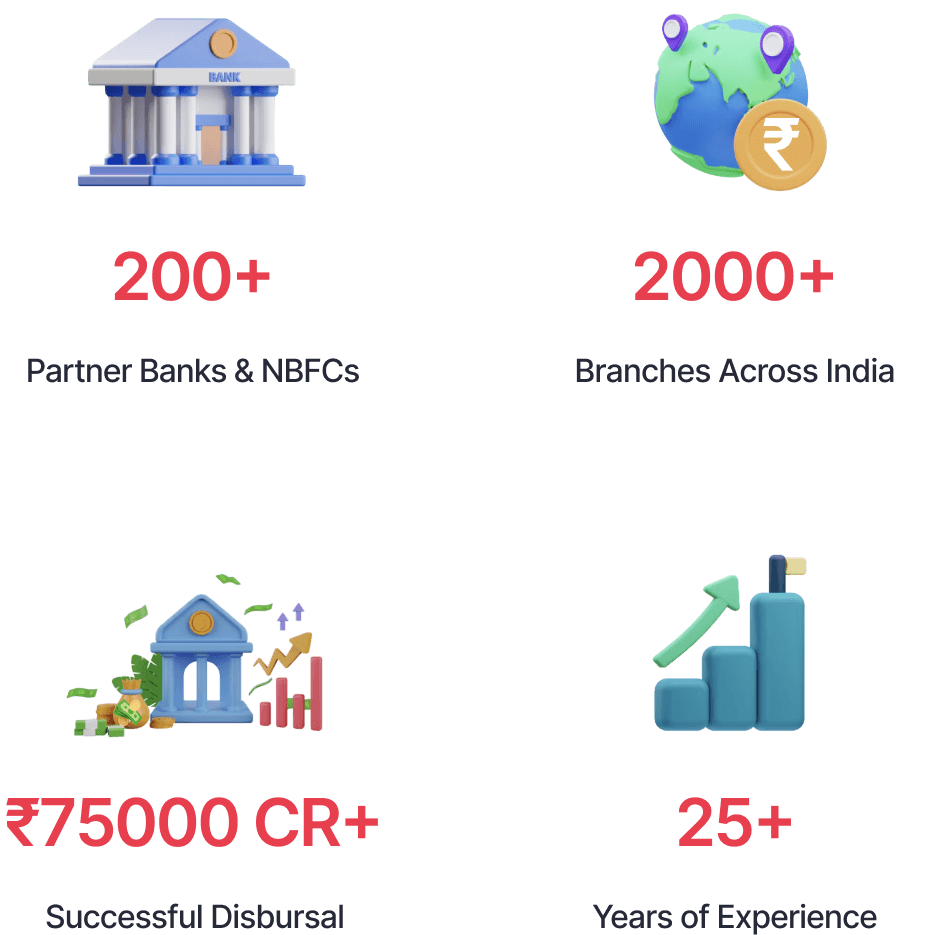

With a PAN India presence across 2000+ cities, Ruloans is one of the leading credit lending establishments founded by professionals and financial experts who with an experience of 25+ years have created a rich profile of satisfying the needs of more than 10 lakhs clients. We have successfully disbursed loans amounting to more than ₹ 75,000 crores from over 200 banks and NBFCs.

Connect with us to help you make your financial decisions right and smart.

Watch Video

We Have The Best Team And The Best Process

Commenced with Standard Chartered Bank Credit Cards

Establish personal loan and telecom business

Progressed into a distribution partner for multi-banks & NBFCs

Initiated national expansion

Towns = 500+

Business = Rs 300+ Crs

Towns = 1,200+

Team = 7,000

Business = Rs 1,000+ Crs.

Towns = 2,000+

Team = 10,000

Business = Rs 1,500+ Crs.

Launched India's 1st B2B channel partner app, RUCONNECT App

Disbursal: ₹26,000 Cr+ (2x of last year)

Partners: 1.5 Lakh+

Towns: 2,000+

Commenced with Standard Chartered Bank Credit Cards

Establish personal loan and telecom business

Progressed into a distribution partner for multi-banks & NBFCs

Initiated national expansion

Towns = 500+

Business = Rs 300+ Crs

Commenced with Standard Chartered Bank Credit Cards

Towns = 2,000+

Team = 10,000

Business = Rs 1,500+ Crs.

Launched India's 1st B2B channel partner app, RUCONNECT App

Disbursal: ₹26,000 Cr+ (2x of last year)

Partners: 1.5 Lakh+

Towns: 2,000+

Client's words

FAQs

Ruloans is an innovative one-stop-shop for all your financial needs, including Home Loans, Personal Loans, Credit Cards, Business Loans, Insurance ,Balance Transfers and more.

Experience: Our team's deep industry knowledge and extensive experience enable us to offer insightful financial solutions tailored to your unique needs.

Nationwide Presence: With a PAN India presence across 2000+ cities, we are dedicated to reaching every corner of the country to make financial assistance accessible to all.

Cutting-Edge Technology: Our internally developed Loan Calculator algorithm and algorithmic engines empower you with accurate, up-to-date, and forward-looking insights, aiding you in making informed decisions.

Customer-Centric Approach: You are at the heart of everything we do. Our customer-centric ethos drives us to prioritize your satisfaction and financial success.

There might be some charges while applying for any type of loan. These charges might differ from lender to lender.

Get Loans From More Than 200 Partners